Travel Buyers Looking to Bring Innovation to Booking Process

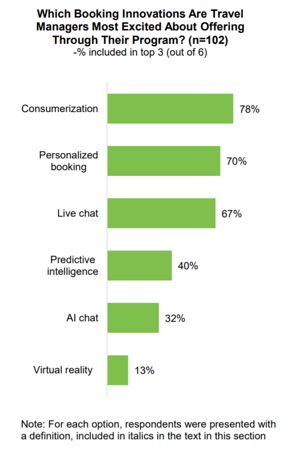

Consumerization, personalized booking and live chat top the list of booking innovations travel buyers are most excited about offering through their travel program to improve the user experience, according to new research out today from the Global Business Travel Association (GBTA) in partnership with SAP Concur. The research explores the evolving role of travel buyers in today’s ever-changing managed travel landscape.

“As the role of the travel buyer continues to evolve, this research clearly demonstrates the impact of the buyer reaches well beyond travel,” said Jessica Collison, GBTA research director. “Travel buyers are often responsible for helping their companies manage risk, improve employee satisfaction and retention, ensure employee safety and deliver on critical business objectives.”

“As the role of the travel buyer continues to evolve, this research clearly demonstrates the impact of the buyer reaches well beyond travel,” said Jessica Collison, GBTA research director. “Travel buyers are often responsible for helping their companies manage risk, improve employee satisfaction and retention, ensure employee safety and deliver on critical business objectives.”

“The business travel landscape has changed dramatically in recent years, bringing greater automation and connected solutions that help reduce the time travel buyers spend trouble shooting reservations and on administrative tasks,” said Mike Koetting, EVP supplier and TMC services, SAP Concur. “However, there are new demands and issues like traveler safety that are now at the forefront. This study shows that travel buyers are focused on responding to the needs of today’s business travelers.”

While the travel buyers’ role continues to broaden, familiar tasks continue to consume a large amount of time. The research shows that data analysis, evaluating or implementing new technology and traveler safety/duty of care are taking up significantly more time for experienced travel buyers compared to five years ago. Despite this, fewer than a quarter spend less time on familiar tasks – such as negotiating with suppliers or managing corporate cards/payment.

Nearly 4 in 10 travel buyers (38 percent) spend less time troubleshooting travel reservations or performing administration tasks though, freeing them up for other priorities. This could reflect technology automation simplifying day-to-day tasks, however, data integration is not widespread yet as only half (51 percent) of travel programs use an integrated travel and expense tool.

Travel buyers are also focusing on improving the traveler experience. One-third (34 percent) of experienced travel buyers spend more time communicating with their travelers or addressing their concerns, compared to five years ago, and most travel programs offer traveler-facing technology.

Traveler safety

Travel safety/duty of care continues to be a growing priority yet, one-third (34 percent) of travel buyers do not know how long it would take to confirm every employee’s safety if an incident occurred. Additionally, only 27 percent of travel programs use an integrated travel, expense and safety tool, which could allow them to use expense data in real-time for traveler tracking and assistance. However, most travel programs do use a safety and security management tool (70 percent) and overall adoption of various risk management services appears to be on the rise.

Booking & Travel Policy

Experienced travel buyers have conflicting views about the recent direction of corporate travel policies. When asked about the recent direction of managed travel policies, 40 percent of experienced travel buyers believe they are generally more flexible today, compared to five years ago, with a similar percentage finding them stricter (43 percent) or about the same (36 percent).*

Out of policy bookings are still fairly common with 37 percent of hotel bookings and 15 percent of air bookings on average made outside of a TMC or online booking tool. These figures are similar whether travel policy is mandated or flexible. Surprisingly, travel buyers from companies with policy guidelines reported nearly identical compliance with preferred supplier policies as those travel buyers from companies with mandated policies.

Travel programs may have difficulty capturing invisible spend as only one in five (20 percent) uses technology to capture bookings made outside of their program. This can lead to difficulties receiving negotiated discounts, conducting pre-trip approvals, locating or assisting travelers in an emergency or preventing out-of-policy bookings.

Methodology

An online survey of U.S. travel buyers was fielded between May 31 and June 10, 2018 with 143 respondents qualifying for the survey given they are buyers or procurement professionals and their organization uses a travel management company for any product or service. Additionally, semi-structured interviews were conducted with a non-random sample of seven business travelers.

More Information

The report, Lost in Translation: Changing Landscape, Changing Travel Programs, is available exclusively to GBTA members by clicking here and non-members may purchase the report through GBTA by emailing Paul Yachnes.